Automating the journey from document to insight.

Canoe provides the automated data foundation.

PrimePlus delivers enrichment and analytics.

.svg)

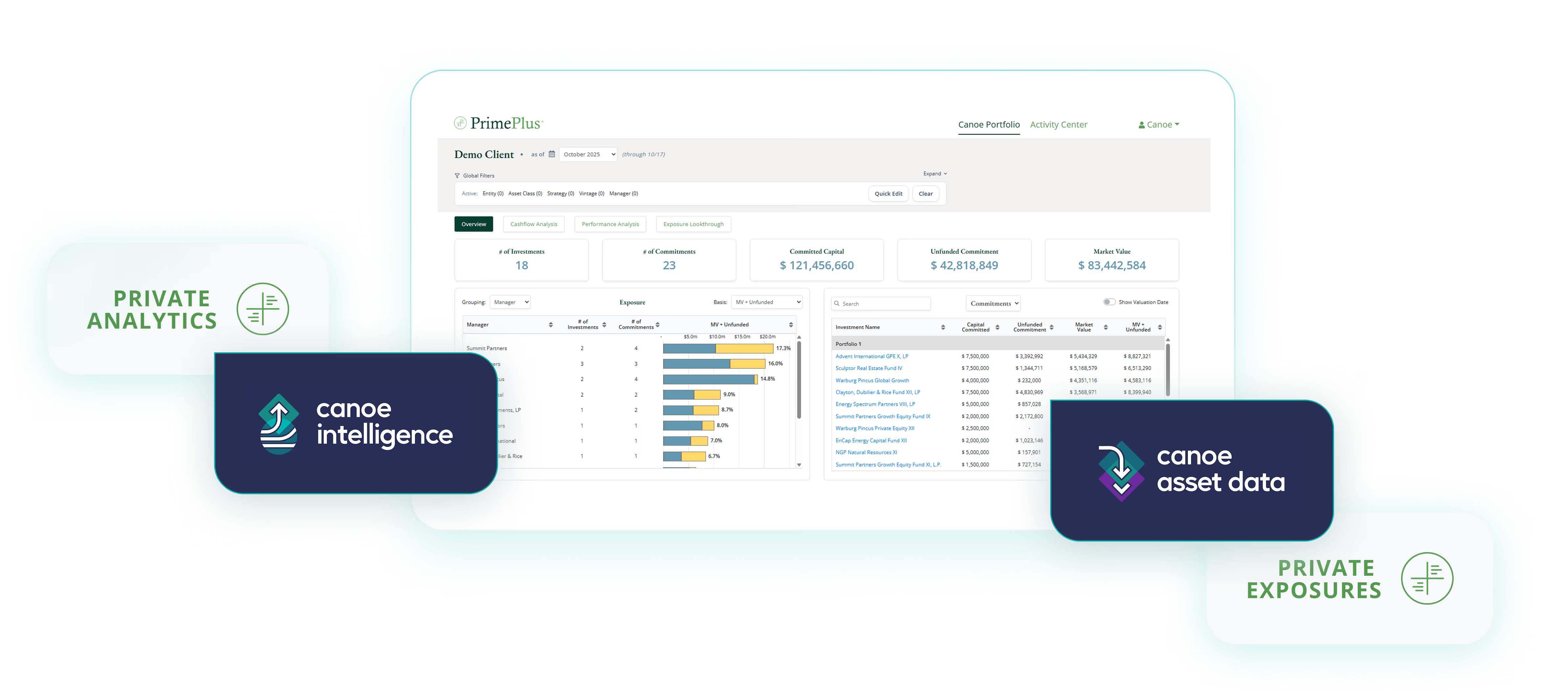

Fully integrated offering.

As an early client of Canoe, Prime Buchholz depended on Canoe's document gathering and data automation to service their 250+ institutional clients. Now refined across hundreds of end clients, the Canoe x PrimePlus integrated offering is available to the broader alts ecosystem as a battle-tested pathway to private analytics and exposures.

Private Analytics

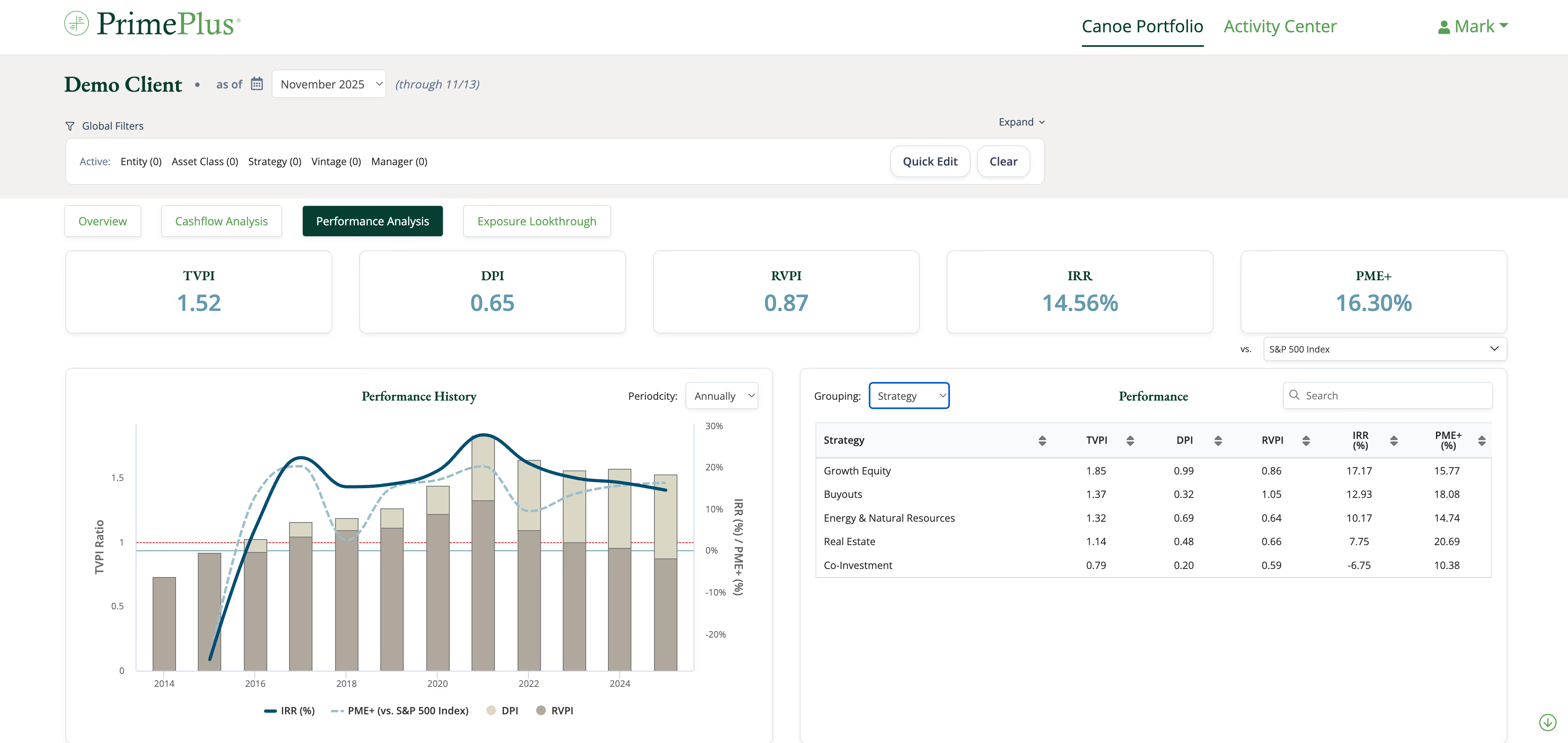

Performance Analysis

Canoe connected data enables IRRs, multiples, and PME metrics over time. PrimePlus supported full implementation required for accuracy.

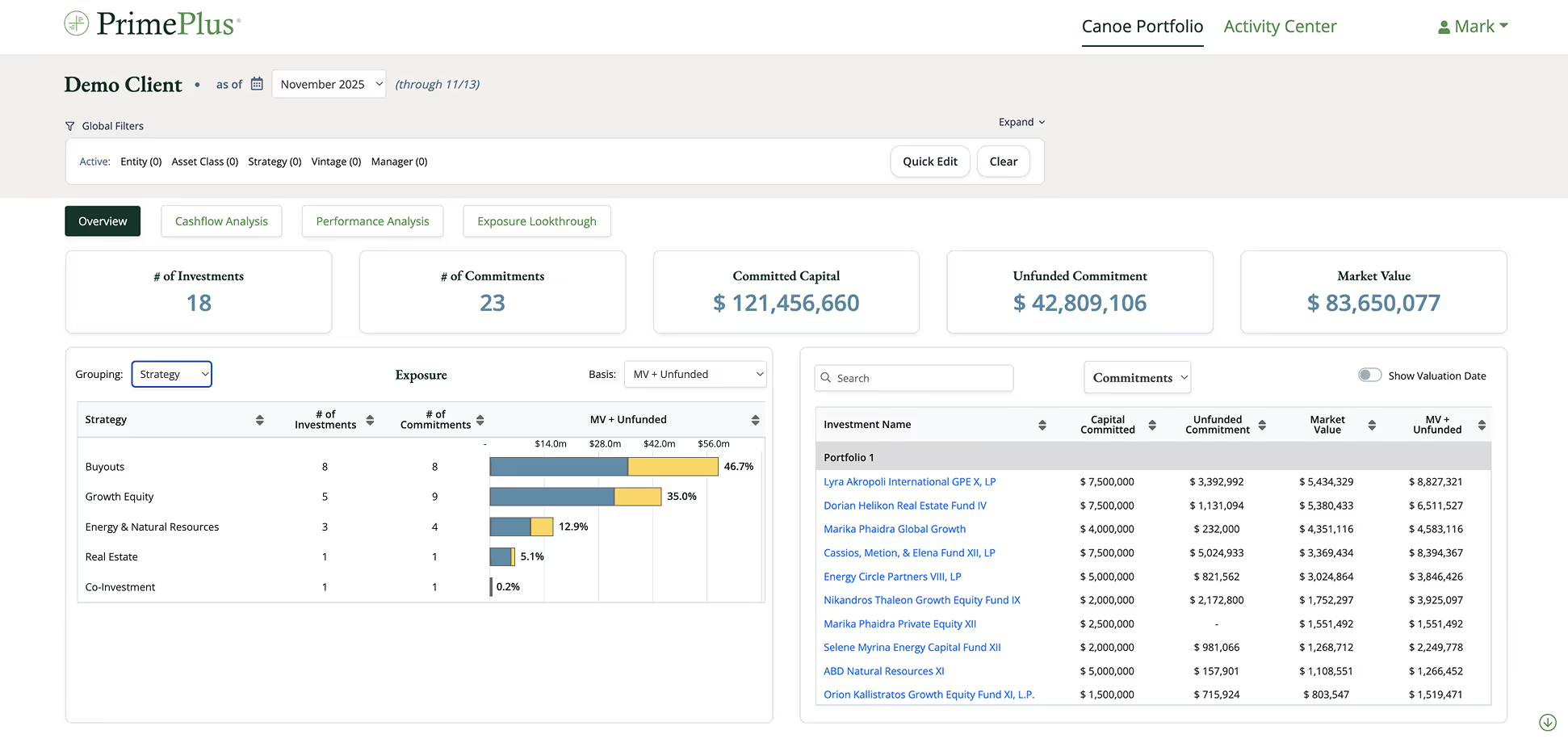

Portfolio Overview

Canoe connected data enables IRRs, multiples, and PME metrics over time.

PrimePlus supported full implementation required for accuracy.

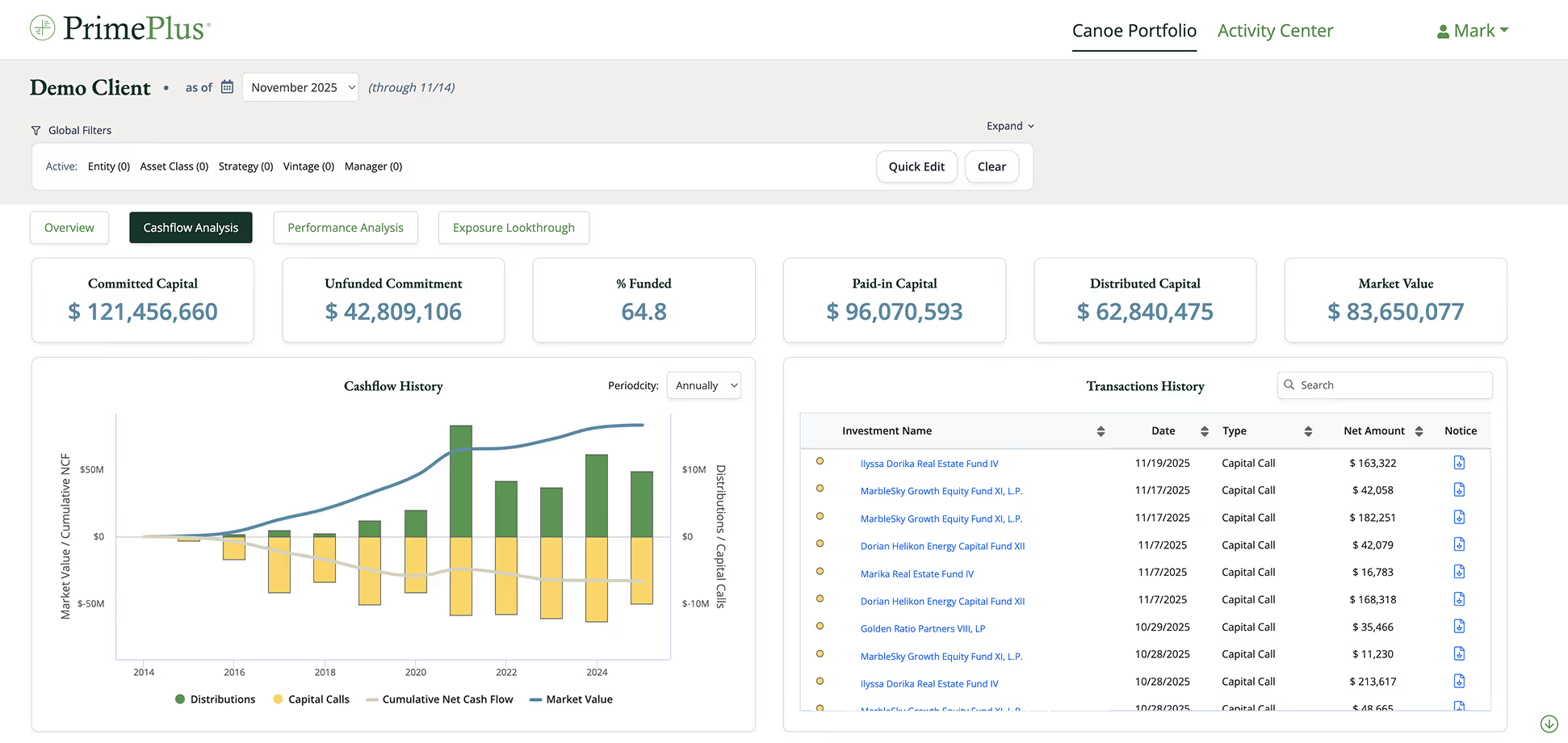

Cash Flow Analysis

Connect connected data enables easy tracking of capital activity and market values over time. PrimePlus supports full data implementation. Documents are interoperable from Canoe.

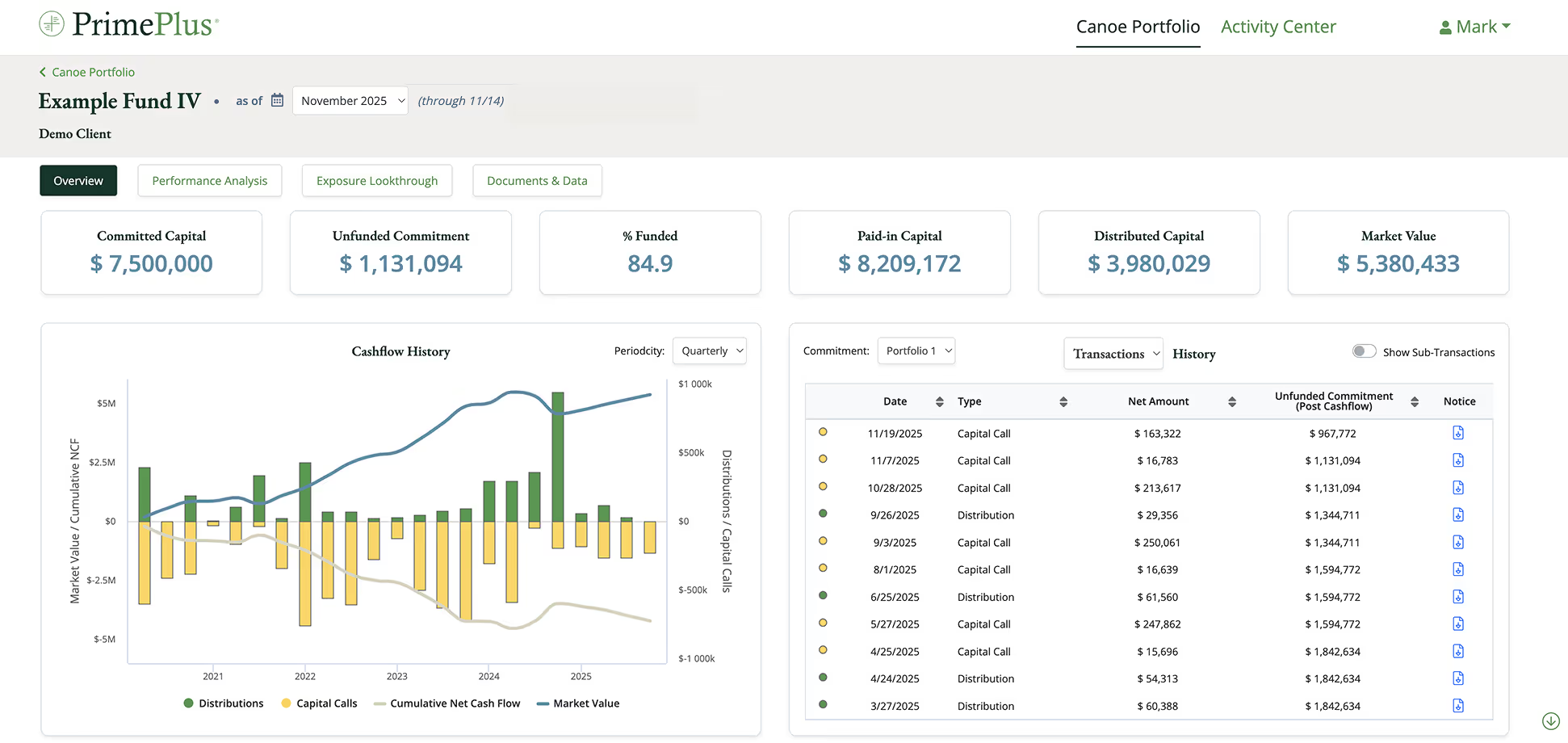

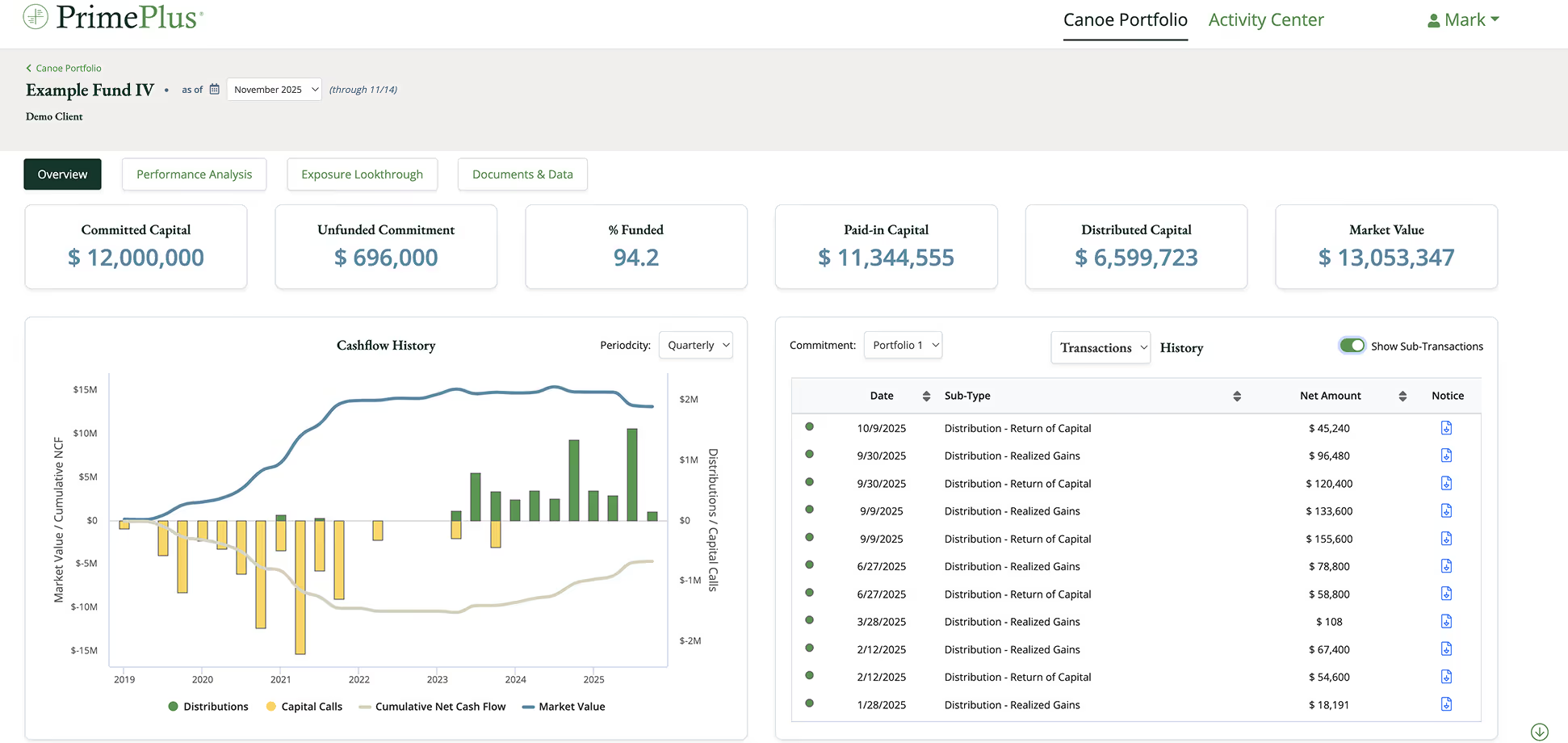

Fund Level Analytics

Every Canoe fund allocation is supported in PrimePlus with consistent visuals, valuation data, detailed capital activity data, and related document links.

Transaction Detail

Track manager documents documents alongside cashflow history.

Private Exposures

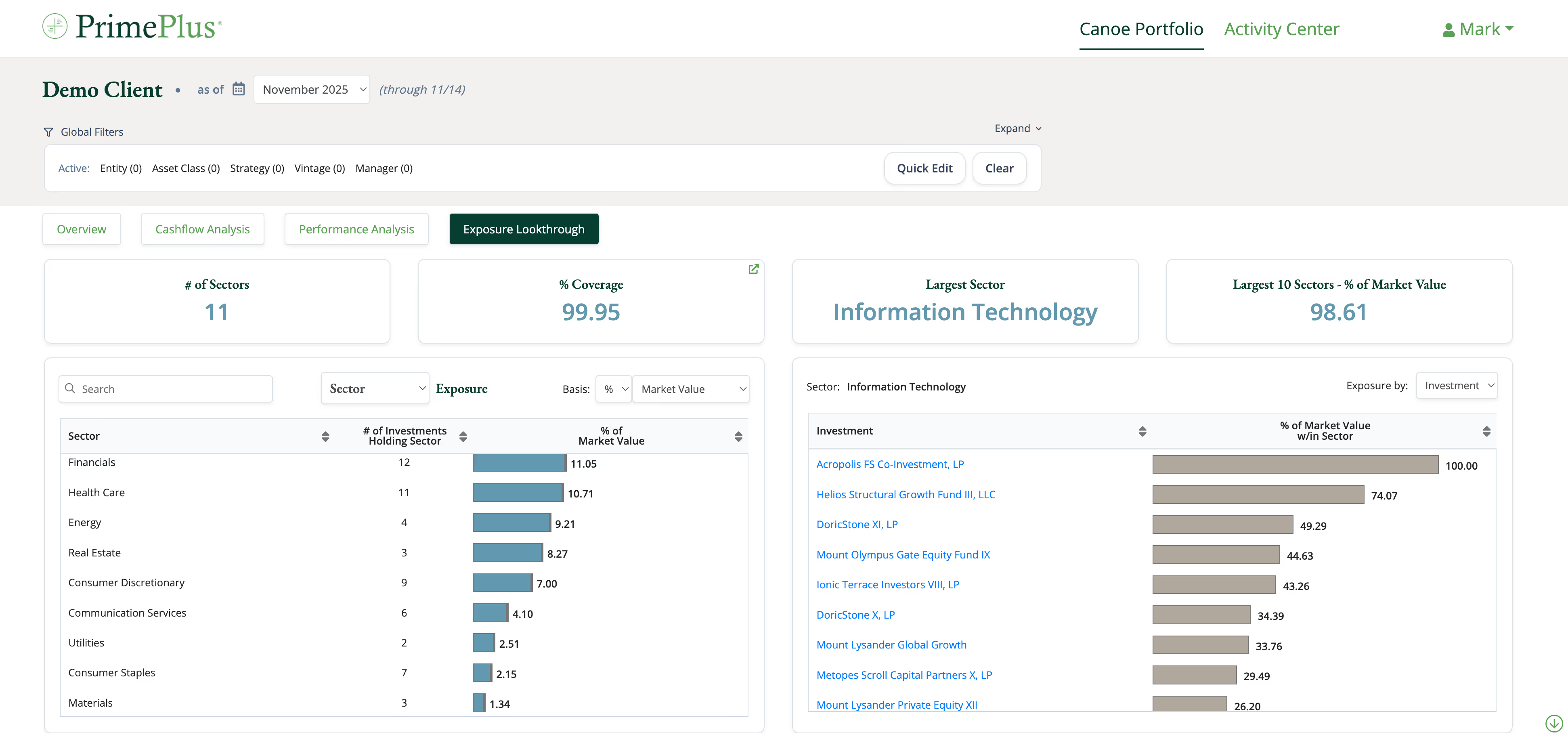

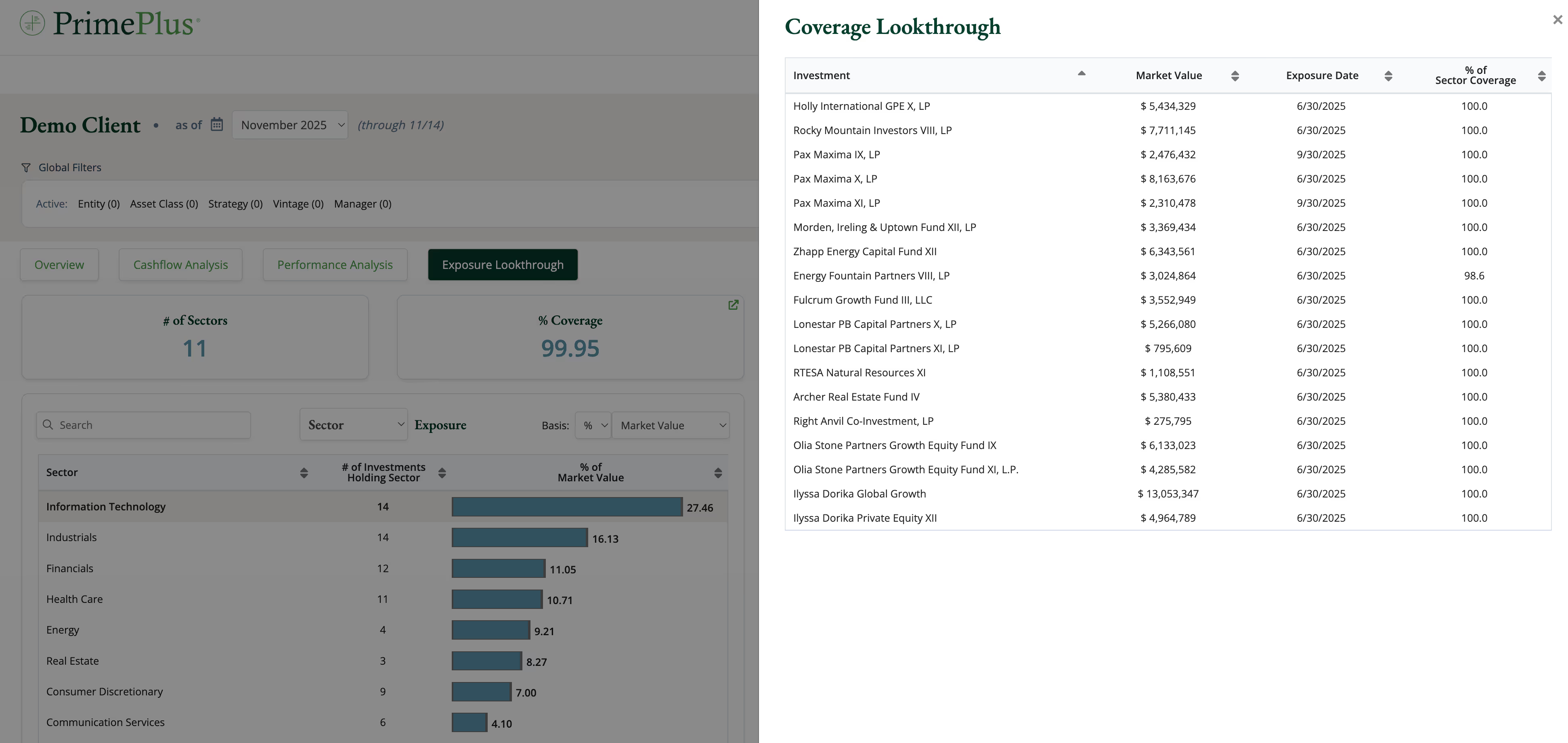

Exposure Analysis

Track aggregate exposures across underlying portfolio companies.

Coverage Lookthrough

Understand relative manager market value across key areas.

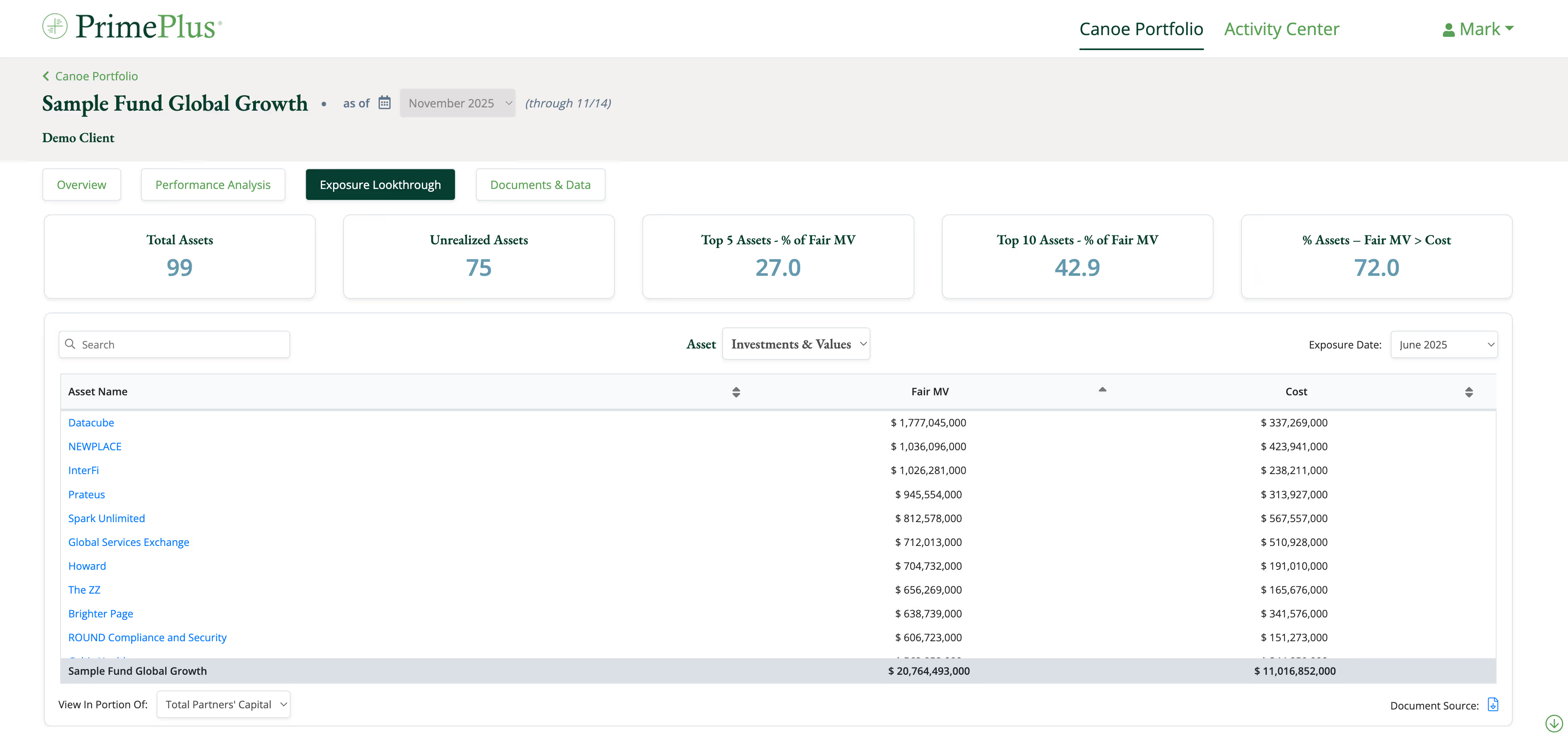

Fund Level Portfolio Company Exposure

Canoe connected data enables IRRs, multiples, and PME metrics over time. PrimePlus supported full implementation required for accuracy.

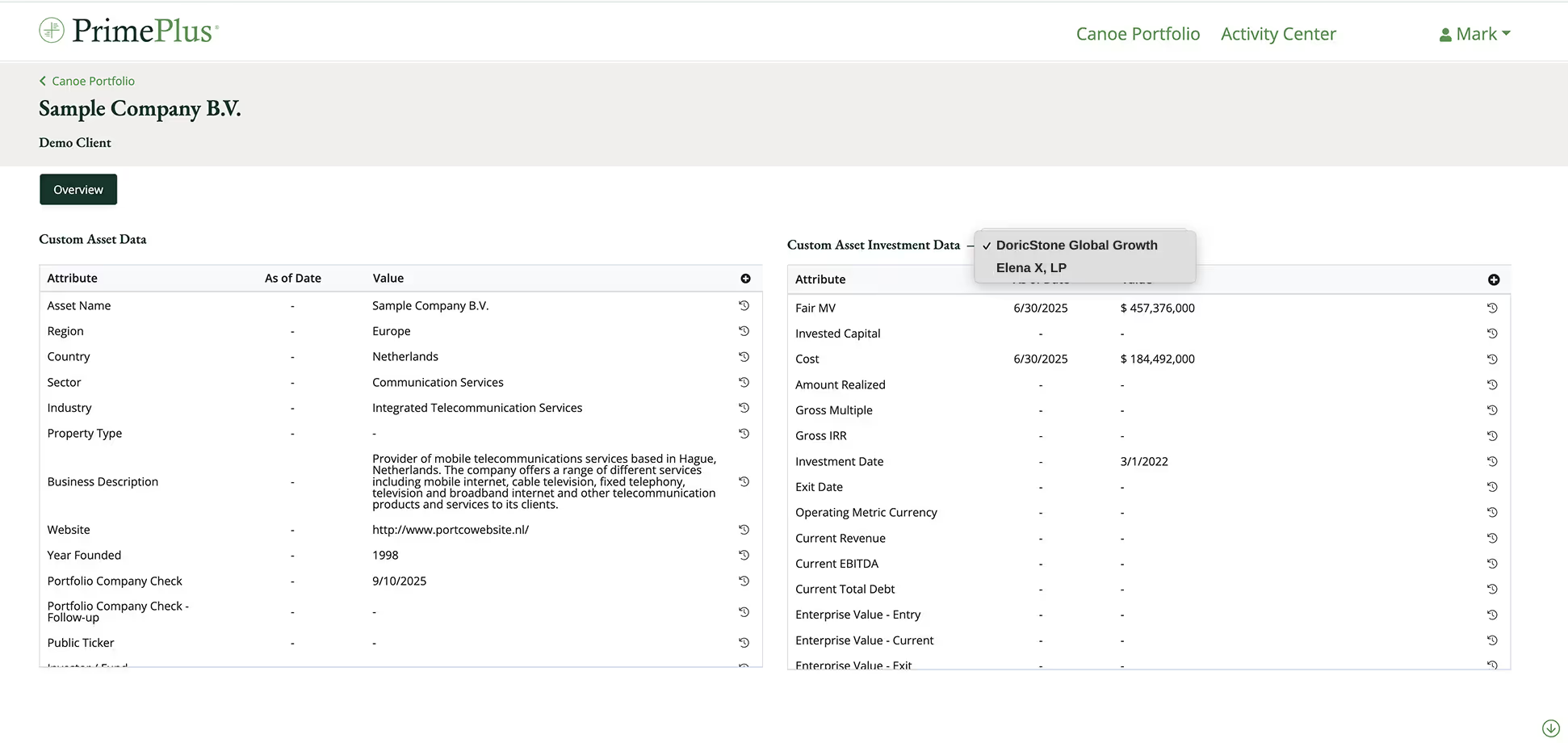

Portfolio Company Level Analytics

Analyze company exposure across GPs and track valuation trends.

Documents to decisions, zero admin.

Faster Answers

Navigate to key intel in seconds, solving what would otherwise take days of manual effort

From quarterly fire drills to always-on intelligence

Hidden risks revealed

Surface concentrations, gaps, and correlations across your entire portfolio

From fund-level blindness to asset-level clarity

Transparency at scale

Reveal data completeness and pinpoint managers who are not fully reporting

Handle 5x the funds with the same headcount

Data & Platform Enrichment

Prime Buchholz manages the client Canoe tenant from a data perspective. Client only needs to manage allocations (creation and closing) and investment hierarchy.

PrimePlus logic engine implemented for exception handling, multi-entity allocation management, custom mappings, and client specific requirements.

Allocation data is complete and validated prior to delivery to PrimePlus.

PrimePlus analytics natively connected to Canoe. Client able to access validated data from PrimePlus.

Seamless data journey.

A fully managed transparency & analytics add-on for alts investors who want to unlock private data exposures & analytics with a unified solution.

Data automation

Canoe collects documents and extracts data from manager portals using Canoe AI, applying 100+ data validation checks and structuring the dataset pre-export.

Managed Integration

PrimePlus applies further data validation & enrichment, provides platform administration, and manages the technical integration—cutting operational burden to zero for clients.

Visualized With PrimePlus

Cleaned, structured data feeds directly into PrimePlus dashboards, with direct API access to trace back to documents and data sources in the client’s Canoe environment.

Stop drowning in spreadsheets.

Unlock clarity with Canoe x PrimePlus.

FAQ

PrimePlus® connects fund data and allocation details to calculate exposure across funds, segments, and the total portfolio, providing a fully integrated view of investments.

PrimePlus® provides detailed insights into data availability and identifies reporting gaps, showing clients exactly where discrepancies exist and why. This ensures a clear understanding of portfolio exposures and data completeness.

The services-tech hybrid nature of this offering means that after setup, Canoe clients will interact with PrimePlus® without needing to manage the integration, perform data validation, or otherwise jump between platforms for any reason.

Clients typically experience measurable time savings and improved transparency within the first month of implementation, depending on portfolio size and complexity.

Yes, the system is designed to manage diverse portfolios, including private assets held directly such as real estate, private businesses, and coinvestments, providing tailored dashboards and groupings for client-specific needs.

.svg)